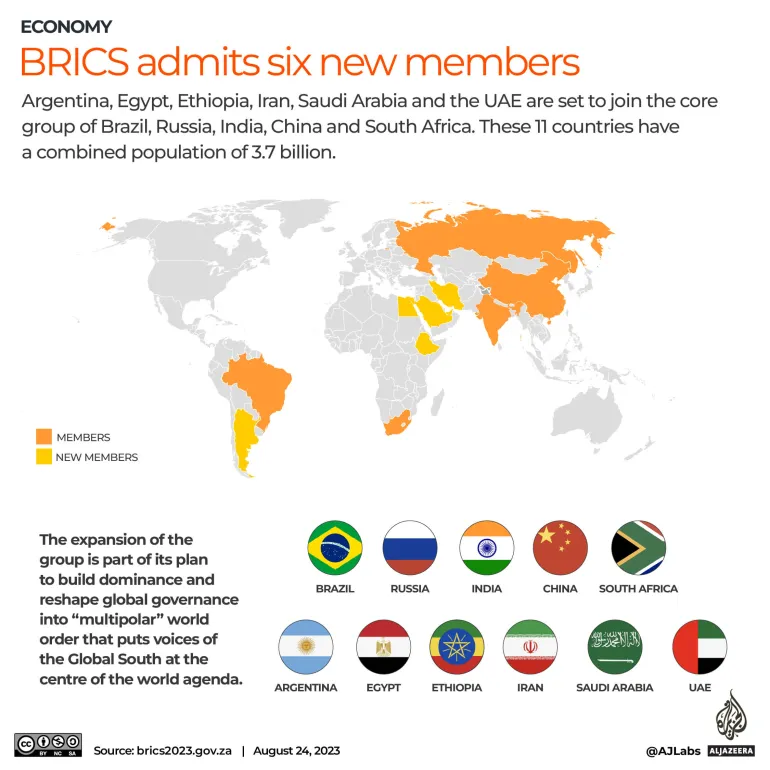

Johannesburg, South Africa – The BRICS bloc of top emerging economies have taken a major step in expanding its reach and influence with the announcement that six more nations have been invited join as new members. Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates have been invited to join as full members from January 1 next year.

The bloc, which was formed in 2009 with Brazil, Russia, India and China, first expanded to admit South Africa in 2010. Now, it is says it is seeking to grow a stronger coalition of developing nations who can better put the interests of the Global South on the world’s agenda.

Before the start of its annual summit in South Africa this week, more than 40 countries had expressed interest in joining BRICS, and 23 formally applied to join. “We appreciate the considerable interest shown by countries of the Global South in membership of BRICS,” the bloc said in the Johannesburg II declaration it adopted on the final day of the summit on Thursday.

It said the six were selected after “BRICS countries reached consensus on the guiding principles, standards, criteria and procedures of the BRICS expansion process” – but did not provide more details about the specific criteria. “It is hard to find commonalities among the six countries invited to join BRICS other than that they are each significant states in their region,” Danny Bradlow, a professor with the Centre for the Advancement of Scholarship at the University of Pretoria, told Al Jazeera. With the inclusion of Saudi Arabia, Iran, UAE and Egypt, “you could argue it’s very Middle East centric”, according to Sanusha Naidu, a senior research fellow at the Institute for Global Dialogue, a South African think tank focusing on China and Africa. “This has geo-economic, geostrategic and geopolitical implications,” Naidu argued, saying the latest additions will push some BRICS nations to think more about their Middle East policies, and for China and India to beef the existing policies.

China recently brokered the re-establishment of ties between Saudi Arabia and Iran, a role that would traditionally have been filled by a country like the United States. India’s recently signed an agreement with the UAE to trade in Indian rupees and Emirati dirhams instead of in the US dollar.

Crucially, Naidu argued, the expansion list is “very energy centric”, adding that following the announcement, some analysts at the venue even facetiously commented if they should “call it BRICS plus OPEC?”. When selecting new members, the bloc may have taken into consideration the pricing of energy products, and how their countries can reduce their liability and vulnerability in terms of the cost of oil, she said. “Besides Russia, all of [the core BRICS countries] are non-energy producing countries. They need to be able to make their economies function, but they don’t want to get caught in the secondary collateral damage of sanctions,” she explained. The use of “unilateral sanctions” against countries and the continued dominance of the US dollar in global trade is something BRICS has vocally challenged.

The expansion “opens up new avenues for trade”, said Karin Costa Vasquez, a non-resident senior fellow at the Center for China and Globalization in Beijing. One of the aims behind the planned expansion is “creating opportunities for BRICS nations to trade more easily with one another using local currencies”, Vasquez added “This shift could increase the potential for using currencies other than the US dollar, particularly by creating a network of countries that enhances the utility of their respective currencies.”

Comment: An interesting title for this al Jazeera article, but what it describes is not a wall. It is a rearranging of the global economic order. I think most, if not all, here would agree that the international economic order is ripe for readjustment. The siren call of global economic integration is sounding a little flat. National and regional self-sufficiency seems to be the new holy grail. This is something Trump really put in motion here in the US and Biden is certainly continuing that trend. Globalists of all persuasions can’t be pleased with this trend.

Change is inevitable. Besides this embrace of self-sufficiency, Putin’s war and the ensuing sanctions regime continues to bring drastic changes to the world economic order. I also think the idea of continued Us economic hegemony is getting stale, even to many in the US.

China, though, appears to be solidly wedded to the idea of world economic integration. They just want to be calling the shots instead of the US. Isn’t that the purpose of the One Belt One Road initiative? This may also be China’s main reason behind the expansion of the BRICS group. In the first linked article below, India’s Modi expresses his concern over China’s motives and the entire reasoning behind the expansion of the BRICS group, which is not yet a done deal. I sense he sees a danger in the drive towards a bipolar world order divided between China and US camps. He does see great value in greater regional economic integration. I don’t know how he views the trend towards nationalization of economies.

Finally, one of the greatest hopes to many and fears to some is the de-dollarization of world trade. The dollars international hegemony is sure to weaken, especially on a regional basis, but it is a long way from collapsing. The second article linked below offers some thoughts on this. Since I am a near macroeconomics illiterate, I look forward to your thoughts on the future of the BRICS group and the international economic order.

TTG

The two largest BRICS economies – China & India are enemies. They have had multiple border skirmishes and in 1962 China invaded India.

Re de-dollarization, the question is which currency is going to replace dollars as the preferred currency for trade by private entities? Yuan?? LMK when a taxi driver in Buenos Aires would prefer the yuan to dollar?

Right. And China’s development model no longer produces growth or increased efficiency. BRICS originated as an acronym coined by an Australian investment banker/trader who worked for Goldman-Sachs, I think. It designated a handful of countries whose bonds were promising in the emerging markets and the abbreviation stuck because it was useful for quickly referencing those investment vehicles. Thus it had no actual physical reality originally as did the EU or 50 US States etc. I can’t recall when the five countries decided to take the idea in hand and decide to consider themselves a thing. South Africa was appended. China is mainly and badly in need of distributing their debt outside their domestic domain or they have huge problems ahead. Central bank of country X Debt and Currency of country X are intimately linked. If they can get enough foreign countries to trade in their currency, their debt crisis is eased. I guess a back of the envelope calculation would involve knowing the GDPs of the countries and how those numbers resolve into foreign versus domestic components. Then you could get an idea of how feasible it is. Right now much of Russia’s oil sales is paid in Indian Rupees, derogatorily called “candy wrappers” because there’s nothing much that India makes for export that Russia needs. A universal digital currency is probably technically possible but very unlikely, though the meta money of the “meta” world of Zuckerberg is an experiment in that direction. If a virtual meta economy became gigantic enough, its currency would be happily accepted by a taxi driver in Brazil who cashes it in for chips to drop into virtual one arm bandits. Enough online gambling and shopping junkies and maybe you could finance apartment complexes and hospitals? Not what Meyer Lansky had in mind but the Chinese are the gamblingest people out there.

F&L,

” Central bank of country X Debt and Currency of country X are intimately linked. If they can get enough foreign countries to trade in their currency, their debt crisis is eased.”

What backs the ECB? What currency do the French, German and Italian central banks issue? How about EU member countries Poland and Hungary? Why do those differences matter?

“Re de-dollarization, the question is which currency is going to replace dollars as the preferred currency for trade by private entities? ”

It’ll have a different name, no doubt, but the basic concept will be the “bancor” that was proposed at Bretton Woods.

“Yuan??”

No, it will be an artificial currency that belongs to no sovereign state, but will be simply a method of exchange between one national currency and another.

“LMK when a taxi driver in Buenos Aires would prefer the yuan to dollar?”

No, the new global reserve currency won’t exist as a physical bit of paper or a coin. It won’t be used at all for everyday retail transactions. It will exist entirely as a means of international currency exchange in international trade.

There is a thing called “Business English” and it is widespread and I doubt there will be a replacements for it anytime soon. Then there is the structure of government among quite a few of these countries that will make it hard to co-operate on enough fronts. Thus, I expect this to mostly exist on paper.It also will be hard to replace the US$ as the most common currency in world trade.

No doubt there will be adjustments to the current system, but they may have to learn about the old adage: If it ain’t broke, don’t fix it. This has more to do with politics than actual economics. As freely as capital now travels around the world, the actual actors will use what works the best. I would use Ford Edsel and New Coca Cola as cautionary tales.

Lars

Ah, but the system IS broken. The West broke it when it decided to weaponize everything under the sun. It weaponized the dollar, euro, maritime insurance, SWIFT, the ICC in Hague, Olympic games and the list goes on and on.

Every non NATO/non Western country now looks at the situation and realizes that their sovereignty can be taken away in an afternoon by the US without a shot fired.

No country should wield such power. A change is needed.

wiz

100%. I’d add the Internet to your list as an important area in which the US is increasingly abusing its power over international organizations/resources that were hitherto assumed to be shared and free of usage conditions.

A look at the Iranian state broadcaster PressTV’s old website is instructive; https://presstv.com. The .com was ‘seized’ by the feds back in 2021. The site that Patrick Armstrong use to post to; Strategic Culture Foundation lost access to its .org a couple of days ago. It is now back up at https://strategic-culture.su

Ooops! Now that is interesting. Thanks Barbara.

Lars,

You think legally binding contracts are written in “Business English “? How did you ever come to believe such a simplistic idea. The two product marketing ideas you mention had nothing to do with international trade or capital flows.

No contracts are written in that language, but a lot of communications before any contracts are in such a manner. My examples indicate that it is hard to replace some things and it may even backfire. As has been pointed out, this group start out with a lot of friction that will not easily be solved. At this point this is the proverbial “paper tiger” and consider that it has taken decades to develop the current system.

Lars I totally agree with you on the issue of difficulty in changing the system, heck it is so hard for us to change our own habits never mind society as a whole. However I don’t think BRICS are planning to change the system over night. They are in for the long game. Just like the British system took years to develop so will be the new system. But from their statement BRICS I gathered that they are in no hurry to change the system. They will start with accepting national currencies at the national level then slowly will move on. Thanks

” National and regional self-sufficiency seems to be the new holy grail. This is something Trump really put in motion here in the US and Biden is certainly continuing that trend. ”

You missed some proof reading. How is self-sufficiency in oil production going in the US? How is self-sufficiency in electric generating production by distancing from global economic integration going? How is Obama holdover and former San Francisco Federal Reserve President Janet Yellen working to make the US independent from “The siren call of global economic integration” as it relates to central banking?

““You have almost a system [akin to] apartheid South Africa where the minority decides for the majority, and that’s still the situation on the world stage today,””

Doesn’t sound like he thinks Christiane Legarde or Janet Yellen have SA interests at heart, or that the latter is moving to distance herself from ‘global economic integration’.

So Fred, I gather you disapprove of current efforts to bring industries back to the US, pushing for energy self-sufficiency and decoupling from the Chinese economy. Who’s the globalist here? Or do you favor forcing US producers to keep their oil within our borders? Wouldn’t that be big government overreach or even nationalization? Imported oil is still often cheaper than domestically produced. As for central banking and economic integration, I have no idea how that works.

TTG,

All central banks can do is print money or raise or lower domestic interest rates. And governments can decide what currency pairs get used in inter-government trade. The de-dollarization crowd have been crowing about the dethroning of the dollar for decades. Remember all the petro-dollar doom stories! Yes, a stuck clock can be right at some point… I read all kinds of hyperventilating stories when India purchased a tanker of crude in rupees from UAE. See what’s happened with India-Russia bilateral governmental trade. Russia is now sitting on a lot of rupees and don’t necessarily want to spend it all in India. Every time there is currency exchange there is some friction (fees & risk) and when you have a non-convertible currency like the Yuan whatcha gonna do? This exchange friction is the lowest in dollars due to the sheer volume of fx transactions every day and the ability to hedge risk cheaply. And when you look at offshore dollar credit issuance where the federal reserve has no control, the scale is gargantuan relative to the lilliputian inter-governmental non-dollar trade exchange.

At the end of the day what matters is what private actors determine. BRICS is a motley crew, some of whom hate each other and have had border military clashes for decades, unlike the Non-Aligned grouping of Nehru & Tito. Where did that end up?

As Sam has reminded us of Thucydides “The strong do what they can and the weak suffer what they must”. Throughout history…nothing has changed as human behavior hasn’t changed in millennia.

blue peacock

Yes, but the important point is that the weaponizing of all the things wiz lists is not a sign of strength, but of weakness. Pax Americana is losing its ability to dominate the world and as a result is resorting to measures which are long term counterproductive, in an attempt to prolong its hegemony. De-dollarization might not happen tomorrow, but it will happen a lost faster than it would have done otherwise if the US insists on making access to the current financial system dependent on ‘good’ behavior. The BRICS expansion (and long waiting list for membership) is a sign that there is great demand for an alternative system free from ideological usage conditions. It is only a matter of time before a workable one comes into being.

BA,

Let’s not lose sight of the physics principle – inertia. Irrespective of the “weaponization” the lag before an alternative financing mechanism becomes widely accepted & used by private actors is some moons away.

blue peacock,

Elvira Nabiullina is working hard to prove you wrong – and while most Russians are as useless as tits on a bull, that woman is very, very competent.

TTG,

I simply point out that Biden, the guy who took bribes in exchange for influencing US policy, isn’t doing what you are saying he is doing.

Why is imported oil “cheaper” now when than it was when the prior administration was in office? What policies did Biden put in place that drove up costs of domestic production?

Fred,

Imported oil was often cheaper even under Trump. We never stopped importing oil during his presidency. All that talk of his energy independence was a lie just like Mexico paying for the wall. Under both presidencies, we still managed to export more crude than we imported. US oil production did fall during the Covid induced economic collapse, but I wouldn’t lay the fault for that at Trump’s feet. No matter who was president, it would have collapsed. Now our production is about to surpass the 2019 production level.

TTG,

” Covid induced economic collapse”

The virus from China did not force any politician to order lockdowns, they did that all on their own. What the status of oil leases under this administration, higher or lower. Pipeline construction to move product efficiently? Built, not built? Should I go on?

Fred,

The panic induced by Covid caused consumers to stay home and politicians to order lockdowns. They didn’t do all that for no reason at all. Trump offered no alternative.

Oil leases are up and so are pipelines except for the Keystone XL. Biden did stop that one.

https://twitter.com/chigrl/status/1695197501580570667?s=21

Petro-dollar!! Lol.

TTG,

“The panic induced by Covid caused consumers to stay home and politicians to order lockdowns. ”

I dare not call you a … sir. Governor Whitmer was in a panic? Governor Cuomo, one time leading Democratic candidate for president, was in a panic? The border was closed due to ‘panic’? Somehow I missed that, like all those who crossed it illegally. Were the George Floyd riots avoided due to ‘panic’? How about all his funerals, did the politicians stay away? At least the guy in Florida didn’t do ‘panic’.

What was it Fauci and Birx did? You have kept up with the latest news I hope. The social media companies did what? Data had what done to it? (Not counting the manipulation by that woman ‘hero’ in Florida who is now in jail) The UK, where both the Prime Minister and the ‘scientist’ from Imperial College disobeyed their own ‘panic’. Lefffffft. ‘Cause that sure ain’t right.

https://www.indiatoday.in/world/story/top-uk-govt-scientist-flouts-lockdown-protocol-by-calling-girlfriend-home-made-to-resign-1675075-2020-05-06

https://www.cnn.com/2021/01/18/us/rebekah-jones-data-scientist-surrender/index.html

Sam,

how’s the natural gas flow to Europe from Russia oh yeah and it was lower price before the ‘boom’, which was why all that American LNG never went there in those volumes before.

Fred,

So I guess this country was without a sitting president during the Covid pandemic. Odd, I thought someone was elected to that office in 2016. And DeSantis declared a state of emergency in March 2020 and locked all of Florida down in April 2020. Only seven states did not declare statewide lockdowns, but they did close schools. I do remember the Lowes and Home Depots being as crowded as a sunny Saturday morning all the time so the panic did seem somewhat perfunctory.

TTG,

Trump got conned, just like the rest of us. There was no federal lock-down order, though we now see that there was a deep-state wide propaganda and fraud campaign. The only ‘panic’ was the left’s, aided by a lot of fellow travelers. We are seeing it play out again now.

At least we are not talking about Maui’s death by diversity, SBF going into jail and staying there (I wonder if he’ll Epstein himself before he has a chance to explain where all that money that went into lefty campaign coffers actually came from?), or the latest news from the prosecutor Zelensky fired in exchange for a $billion bribe that not a single main stream news outlet has ever asked him for an interview. Shocking I know.

Keep in mind that the FIRE sector dominates now. Finance, Insurance, Real Estate. Finance is the largest and essentially virtual as is insurance. It’s a whole huge world whizzing around at the speed of light. Real Estate is real but it’s trade is through financial instruments such as mortgages, the deceptively u untransparent packaging and electronic resale of which led to the 2007 bust. It’s a hugely crooked industry. Winston Churchill’s mother was Jenny Jerome of Rochester NY whose dad was a major wheeler dealer in early wall street shenanigans. Jerome Avenue in the Bronx. So was old Joe Kennedy before FDR got him to help clean up the street because he was a master of the pump and dump schemes and knew the crook’s tricks because he invented many of them. Imagine a huge bank of the future run by ultrafast quantum supercomputers which had instantaneous access to every smartphone and surveillance device. You’re broke and moan about it in an SMS to a friend or business partner. At the speed of light the machine arranges loans or simply takes funds you need from any of a billion pools it has access to and transfers it to your account. So you buy a house or a car or anything. Those funds – deposited electronically – are now available for the supercomputer to filch to replenish the accounts it robbed or borrowed from for your purchase needs. Meanwhile of course, little Nell on Drury Lane doesn’t hang herself because she can’t pay the veterinarian for her puppy’s operation because covert surveillance has handled it already and surreptitiously made her phone fall out of her pocket showing a message “your funds have ckeared” or “pick up your lottery winnings, your Aunt Maggie bought you a ticket that won..”. Crazy yes. But that’s actually how insane banking and finance is – that’s going on constantly and invisibly but with very different motives. One day it will happen though. Thing is, Little Nell grows up and learns that she’s very desirable .. . No scheme like that can ever work in the long run because of the 2nd law of thermodynamics. But tech could be put to better uses than to accrue all the wealth to 250 people. Big challenge. We seem to be on our way though.

.

F&L,

FDR? That’s ancient history, like Vespasian telling his son “Pecunia non olet”. You should at least touch on Silvergate, SVB, FTX and …. drumroll…. bitcoin! Not to mention the San Francisco Federal Reserve’s oversight of all of those now busted banks. Guess who (cough cough Yellen) trained the leaders of that FRB.

Next take a look at the ECB; just what backs that up? What reserves, exactly, does it really have? What did the ECB have interest rates at in the EU for more than a decade? Where did that ‘capital’ flow when the Fed replaced LIBOR with SOFR and shortly thereafter started raising rates? Yellen btw none too happy about that…. Powel, sources say, is 9th generation American. Old money. He gave up what kind of wealth creation to return to the Federal Reserve? I think he really doesn’t want euroweenie (Luongo reference) central bankers replacing commercial banks.

for the video needy: https://www.youtube.com/watch?v=zTFhnpf-IE0

The spirit for a BRIC based medium of exchange is willing, but the flesh is weak.

First, to be a true reserve currency, the BRICs would have to subject themselves to Triffin’s Dilemma (be prepared to run sustained trade deficits to flood the world with their currency). And China for one has a 100% mercantilist model.

And for the other reasons please read:

https://mishtalk.com/economics/what-would-it-take-for-a-bric-based-currency-to-succeed/

Very interesting, thanks.

Exactly! This is a point most de-dollarization folks don’t get. Ask the simple question why doesn’t CCP make the Yuan convertible?

For the Yuan to become the reserve currency they’ll have to abandon mercantilism. Fat chance anytime soon. The minute the CCP make the Yuan convertible capital will flee Hotel Xi led by the CCP apparatchiks.

They gained their miracle growth decades at the cost of debt that is absurd. Many of the projects were left unfinished or if completed, unused. I’m skeptical that there’s enough trade potential out there to solve the problem for them but I haven’t done the math. I’m not impressed with Brazil and India in general. China and India are hugely overpopulated, it’s insulting but they are named “Asian anthill societies” for a reason. Probably the working model will be the one in effect for a few hundred years now – migrate to North and South America. It’s gonna be messy like it always was. Why can’t the Dollar become the Universal currency? Isn’t it already for trade? Why is that actually broken? Is it? Local currencies are similar to company scrip for slaves by comparison, and though it’s not fashionable to say so that’s what the vast number of people are in most places.

the CCP’s local government debt is massive Some reports have it as high as 9 trillion USD, Epoch times has it at about 7.8 trillion USD. All articles seem to agree that this is double the projected numbers and farther speculate that the CCP will have to intervene to prevent local governments from insolvency.

https://www.theepochtimes.com/china/china-saddled-by-almost-double-local-government-debt-expert-5480630

August 17th Evergrande filed for bankruptcy in the US Bankruptcy Court in New York.

“The world’s most heavily indebted property developer Evergrande Group filed for bankruptcy in New York on Aug. 17 amid China’s deepening property crisis.

The filing under Chapter 15 of the U.S. bankruptcy code shields non-U.S. companies under restructuring from creditors coming after their U.S.-based assets. It came after the firm put off meetings regarding a $3.2 billion restructuring plan to keep the company afloat.

Evergrande’s affiliate Tianji Holdings also sought such protection on Thursday.”

https://www.theepochtimes.com/china/chinas-evergrande-files-for-bankruptcy-in-new-york-5473817

The bankruptcy Court filing details are in another Epoch article.

“The company said it’s in restructuring talks to pay off creditors in Hong Kong, the Cayman Islands, and the British Virgin Islands. Its electric vehicle unit, China Evergrande New Energy Vehicle Group, on Monday announced a debt-for-equity swap plan that would give a 27.5 percent stake to Dubai-based mobility firm NWTN to raise $500 million.

Evergrande said in a filing on Friday that its bankruptcy protection application to the U.S. court is a normal procedure for offshore debt restructuring and does not involve a bankruptcy petition. It clarified that its U.S. dollar-denominated notes are governed by New York law.

Taiwan-based economic analyst Edward Huang told The Epoch Times that Evergrande is likely seeking to separate its overseas assets from those in China so that it can avoid creditors in China.”

https://www.theepochtimes.com/opinion/evergrande-bankruptcy-the-implosion-begins-5477624

Another article on the ‘cracks’ forming in the financial and real estate sectors

https://www.theepochtimes.com/opinion/real-estate-and-financial-sectors-compound-chinas-economic-woes-5480416?ea_src=frontpage&ea_med=business-1

My thinking is that this ‘restructuring’ is going to get ugly. correct that… It already is.

kj

I need to tag on to my post a little

That 9 trillion in debt is attributed ONLY to local governments in mainland China, The CCP records an economy that operates at about 848 billion in the black… ALL Debt, both government and private are (clearly) ignored. The numbers of unemployed millennials and Gen Z in China is so high that the CCP has simply stopped reporting the numbers. The 9 trillion in local government debt is well and over any profit the CCP reports and puts their economy quite clearly in the red.

What I cannot get past thinking about is the RESTRUCTURING going on right now in China. Restructuring needs big INVESTORS… and the recent BRICS members seem to be just that. These ‘new members’ will be in place to take control of assets.. I keep wondering, Are they new members or vultures?

Vultures have no ability to make typical bird sounds but they have quite a hiss.

https://www.allaboutbirds.org/guide/Turkey_Vulture/sounds

KJ,

The BRICS other than China very likely are central to the restructuring you’re talking about, but it’s a work in progress and iterative much like the weather whose inputs at time T(j) are the the weather at time T(j – 1).

They need more trade, yes, they need resources that those country’s borders encompass, and it seems reasonable to suppose that in order to facilitate trade, they will <> those countries money in the form of Yuans. Having those Yuans in hand, those countries can then purchase from China the many products that its increasingly modern industry and services (they are quite high tech and info savvy) have on offer. Since currency is very much equivalent to debt, (to my limited understanding) such procedures can possibly go some distance toward solving their huge debt problem. If China becomes the provider of consumer and other products to a wide enough portion of the economic world, which seems to be the case already, then their own debt can be sold off as interest bearing instruments much as other governments such as ours do. I’m a bit fuzzy on the details of it all but it seems that doing things like that can alleviate their debt problems by not only making it a more widely shared problem but by also greatly bolstering trade which can be enriching to the wider environment. I’ve read crude explanations using phrases like “dumping debt overseas,” but I’m leery of such talk because it makes me suspect that either the writer doesn’t quite understand the topic, that I don’t, and or that its a “tell” – in that by using such undiplomatic language they are casting aspersions on them (China) for things we do everyday and praise ourselves for and couldn’t survive without.

So I think you’re right that its a needed step toward getting out of a fix that they’re in. I regret not being more educated economically and financially to estimate its odds of success. It does appear though that they start from a position of great disadvantage compared to ours, in that we had the very promising, talented, industrious and highly educated countries and cultures of Germany, Japan, South Korea and others on which to try the launch our endeavors, whereas in my opinion and that of others more knowledgeable, the BRICS partners which are on offer for their venture are not at the moment as promising. Especially given that India is in a conflict with them etc. But that said, we are in serious decline and internally riven, and probably quite unproductively “bulked up,” and seem to have a mind to continue being so.

And then the unthinkable for Xi, he looses power. If the yuan is allowed to float on the open market…same thing.

KJ Heart,

Are they-BRICS- new members or vultures? No. I’m betting sheep.

Whitewall and F & L

I am not expert – just watching the financial ‘fallout’.

Shares of Evergrande were finally traded again today in Hong Kong, trade was suspended in March of 2022. The values of the shares fell 79% and dropped below one US penny per share – this is all shoring up the liabilities (debt).

I cannot ignore the timeline correlation with the Ukraine war and the CCP financial troubles. (it may be unrelated – just that saying – ‘there are no coincidences’

Speaking of coincidences – Prigozhin’s airplane crash (after explosion) along with his ‘higher level Wagner Group leaders’ leads me to wonder if Prigozhin remembered to change his will? There is quite a bit of internet talk (backed by articles) that the RM (Putin) is absorbing the Wagner Group – those assets are not small.

Lots to speculate about -that is for sure.

kj

There’s the rub. That’s China’s big hurdle. Is there enough potential out there to create a large enough pool which trades in Yuan – large enough to overcome the inertia of the humongous Dollar pools? Will take lots of time, meanwhile US policy hobbles their attempts. They should rightly be furious as are other sanctioned countries. Their behaviour in general is nothing to write home about though. It’s simply infuriating that the US dictates to everyone. Nothing will change until the US and it’s alliance’s naval power declines significantly. The US dollar is not backed by gold or silver, it’s backed by the Navy & Air Force. Might change if the debt gets unmanageable. Then the US as a country will go away and it’s military will be purchased by something else I can’t quite envisage or it’s return to a free for all on the high seas. If a competing rail system was built the Air Force and special forces would destroy it. China is a long way from challenging the US navy. Our enemy is ourselves. On that front we conquer new frontiers every week.

James Nawrocki,

Here is a suggestion for how BRIC can create a medium of exchange – they can have their banks issue “Eurodollars”.

JamesT,

Sounds like the balboas down in Panama.

JamesT,

Who is going to buy those bonds denominated in Euros and what is going to happen to them when the FX rate on Euros changes? Like when the ECB needs a bailout, which won’t be long.

JamesT

They already do. Any bank outside the US could create dollar credit which is labeled “Eurodollar”.

This is one reason why the dollar is so widely used. Then there’s the dollars that get exported from the US as trade deficits. Irrespective of what governments in BRICS may desire it is the private market of businesses who use fx that is the big volume.

My favourite paper on the dollar as global reserve currency is the one below. Written by Krugman back when he was writing great economics papers and books and he wasn’t a partisan pundit.

https://www.nber.org/system/files/chapters/c6838/c6838.pdf

Krugman is a Nobel Prize winning economist – he didn’t get that out of a cracker jack box. The upshot of the paper is that there are very strong economies of scale and network externalities that push those engaged in trade towards a single currency in which to conduct such trade.

James,

Krugman wrote than in 1984, when the USSR and the Berlin wall were still standing. He didn’t see the collapse of either coming. Much else has changed since then.

James; didn’t Obama get a Nobel Award out of a cracker jack box? Well, he got a Nobel b/f he did anything, anyway.

I’m not happy with it, TTG. We’re looking at the formation of an alternative security and trading bloc. The big selling point that bloc has at present is that it is not the West.

OK, that’s a great selling point for those countries who’ve experienced or are experiencing the way we throw our weight around. For them it’s give me liberty or give me death time, sometimes literally, and naturally they’ll head for liberty if they believe that belonging to a different bloc will give them relief from the predatory and often destructive attentions of the West.

Syria, for example, would not exist now had it not been saved by Iran and then Russia. Of course it can only head in the direction of an alternative bloc, if all our Western bloc can offer it is demolition. Libya had no such means of salvation and got demolition. In those circumstances any country will run for cover where it can.

So as Russia and China, themselves at some risk from the West, seek to draw other non-Western countries into alternative security and trading relationships we in turn are forcing those other countries their way. In that sense, we ourselves are the selling point for this nascent alternative bloc.

Then there are countries, an increasing number of them, who suspect the West may be heading for economic dereliction and are jumping ship to find more stable trading relationships. Or who at least are cautiously hedging their bets and looking to keep a foot in both camps, which is surely what we are seeing many countries do right now..

But these selling points should not obscure the fact that what we are also witnessing developing in this alternative bloc is merely an alternative form of globalisation. Where are the safeguards in this alternative bloc that will prevent predatory or destructive behaviour on the part of the more powerful players there. The potential for predatory or destructive behaviour is greatly increased in a globalised world. Can there ever be safeguards against that?

I don’t believe there can be. Globalisation is inherently undesirable, for that reason and for many others, and we should not welcome it whatever form it takes.

EO,

“Libya had no such means of salvation and got demolition.”

The Libyans could have built a cross-Mediterranean oil pipeline to Italy and ensured both a steady cash flow and low cost fuel to Italy. That ran afoul of both Brussels and City of London; as well as the globalist neocons/borg.

Fred – Obama said he wouldn’t have done Libya had he not been pushed into it by the French and the British. There are emails and documents to prove his point.

They don’t prove it very well. “We came, we saw, he died” showed that there was at least a faction in Washington that found the demolition of Libya agreeable. And Obama had to supply the bombs and missiles with which we destroyed the Libyan forces. Whichever party pushed the other into it, or assisted, it was a joint Western enterprise and was seen as such by the rest of the world,

Putin’s 2015 UN speech (“do you at least realize now what you’ve done?” in the somewhat inadequate Kremlin translation) – laid the blame squarely on the West as a whole. For the watching world, I don’t think it mattered much whether it was the big dog or the poodles who delivered the coup de grace.

For me as a Westerner, of course, it matters very much indeed. We see in the States a virulently hawkist faction that now determines US foreign policy. ( Colonel Lang, https://mepc.org/journal/drinking-kool-aid). The remark attributed to Ledeen ( “Every ten years or so, the United States needs to pick up some small crappy little country and throw it against the wall, just to show the world we mean business.”) showing, as does the Clinton remark above, the extreme side of American exceptionalism.

And there most people stop. Big bad Americans. Case proven.

Except it’s not like that. Enter European exceptionalism.

Borrell’s “Garden in the Jungle”, off the cuff remark or not, shows we go even further. A lot further. Blair’s egging on of Bush 43, the Franco/German/EU ambitions in Africa and the ME, the help the Europeans, HMG in the lead, gave to the American neocon attempts to pine Russiagate on Trump, and in my view the recent European actions pre-February 2022, show the European powers fully or more hawkish than the US.

With HMG striving for primacy still. (“Delivering the leadership that the world turns to Great Britain to actually provide.” https://www.gov.uk/government/speeches/the-munich-security-conference). Hate to have to tell you, but Westminster is now wall to wall neocon with the possible exception of the Downing Street cat.

What is only a neocon faction in American politics is now in Europe not just one faction among many. The entirety of the governing elites in Europe is now neocon. With almost no democratic control of those elites to speak of.

The poodles are off the leash, Fred. Have been for a while now. Except the PR’s so good (“Garden in the Jungle” my foot!) that no one much has noticed yet.

They’re still poodles. E.O. you continue to speak of western Europe as though it was Europe. Great Britain (it aint great anymore), France (I heard Macron and Trudeau are dating), and Germany (still hoping for renewed Russian gas and oil) are/n Europe. Are the Hungarians, Georgians, Serbs, and Slovaks also “off the leash”? Lets go to where you are comfortable. Are the gov’ts of Spain, Italy, Switzerland, Sweden, and Denmark filled w/Neocon war lords. Although I shudder to think what their armies combined with Macedonia could unleash on the world. You are the realist on the board. W/O American money, will, and manpower western Europe has chosen to be a group of irrelevant pansies while eastern Europe is still a site under repair after 70 years of communist/socialism. As for BRICs, they are poor, unstabile, only three have valuable commodities, and thus BRICS will be unable to guarantee stability to an international market. I give them A+++ for trying.

EO,

Poor Barack, he couldn’t just be President and say “No” to second tier powers? Kind of like when Samantha Powers decided to vote at the UN the opposite way she had been instructed by Barack – the president- who proceeded not to fire her. As if.

“Obama had to supply the bombs and missiles with which we destroyed the Libyan forces.”

You mean the British and French ran out of ammunition way back when? My my. What have you been doing with your defense spending?

“Whichever party pushed the other into it, or assisted, it was a joint Western enterprise….”

Not the UK not the UK!!!!

Sure.

“gave to the American neocon…”

so much for national governments or a nation’s leaders being responsible thereto.

“For me as a Westerner,…”

So you have ceased being English and are a transnational now?

“Westminster is now wall to wall neocon….”

The scales have fallen from your eyes!

What was it The Right Honorable Leo Amery told Neville in the House of Commons? “Speak for England!”? Too bad none in elected office over there care to do that now.

There seem to be a lot of Borg (Pat Lang reference) around and about now. Sadly, the neocons have been there all along. Busy trying to put the monkey on somebody else’s back is all they are up to now. Especially as this house of cards, along with the European economy, is collapsing. We should probably get a little gentlemen’s bet going on which sanctuary city Zelensky winds up in, and to make it exciting, with how much.

We have to go back to burning witches. Do you see all the troubles since we stopped? You object. Ok. Maybe heat them up till they’re a bit uncomfortable and see how that goes? If it doesn’t pan out then it can’t put it off.

E.O “inherently, INHERENTY? undesirable”. Why? Nation states (which as one wag said are mere lines on the globe, vaporous and arbitrary) w/b eliminated and so will infantile love of country. The world economy will be controlled by elite leaders of a “central administration”. Economy of scale and advantage of resources will insure no excess production. In fact, the CA will decide what to produce, how much, when to produce, how to produce, and how production w/b distributed. The central authority will set all wages to insure economic equality. Since no one, from Africa to Iceland, w/h more than another there will be no crime and no jealousy. W/O crime, jealousy, or parochial disputes the CA can run the world w/o an army. Every child w/b schooled according to a CA approved curriculum so ultimately all will think alike. Every one WILL AGREE that the CA governs best b/c no energy may be wasted convincing the unenlightened. Appointments to the CA will be made from the Platonic Order of Elites . How one gets into that body is TBD. What’s not to like. Be reasonable E.O., you know resistance is futile.

I don’t think that will happen, Bill. Those running the show don’t have the administrative ability to do all that, even if they wanted to.

More likely the income gap will just widen further and we shall return to a serf and master divide. The job of the intelligentsia, as in mediaeval times, will be to teach us that that is the natural order of things. The job of the Armed Forces and Intelligence Services will be to keep those who refuse to be taught in line.

The job of the psyops people will be to get us howling at some enemy other than those in charge. As I’m seeing today in England and Germany and as seems also to be happening to a lesser degree elsewhere.

Most important to give us a chance to let off steam safely. It must have been something of a relief to HMG when the Ukrainian war came along. After Covid and one or two other things there was a lot of dissatisfaction around. We could howl at the Russians rather than at our politicians. Handy.

I found Orwell a bore when I read him a young man. He’s not a good writer, it’s not a terrific story line, and his dystopian fantasy seemed almost hysterically unrealistic. And yet here we are, bang in the middle of his 1984, Two Minutes Hate for the proles and all.

Though the unassuming and cautious Putin seemed an odd Emmanuel Goldstein. We had the larger than life Trump before that as the hate figure and that was for many a more satisfying howl, I always thought.

You putting that man back in the Presidency? In 2016 I was pretty sure that Trump was all the stood between you and dystopia, Looking at what’s been happening over your way the last couple of years I’m even more sure now.

E.O. if he overcomes the swamp I will vote for him… You make an interesting comment about serf and master. Such a division to be the natural order. Many years ago I had a fleeting conv. on SST w/Col. Lang about that very question. How could anyone abide slavery I wondered. He opined that most would accept slavery, in fact choose it as it might be the natural order of things. Only a small % of humans who would stand against it. Plato knew about slavery. Having trouble sleeping lately. Think I’ll pick up my old copy of his “Republic”, yawn.

From a Russian propagandist on Telegram – the lineup for BRICS+.

Not insignificant — on paper.

BRICS, from January 1

1. Egypt is the largest and most influential country in the Arab world.

2. Saudi Arabia is the richest country in the Arab world, the richest country in oil resources.

3. The UAE has been the most dynamically developing country in the Arab world for many years and is also very rich and has a lot of oil.

4. The most active Muslim country in the world. Ancient Persia, a huge country, a lot of oil. The actual military ally of Russia.

5. Argentina is the second most powerful country in South America.

6. Ethiopia is a large country in Africa, Russia’s ally for many years. But recently came out of the civil war. The reason for choosing it is not very clear.

7. The name will be BRICS + for now.

8. BRICS is evolving. True, there is no single policy. And there are no active common BRICS programs in the world. In general, the most influential organization in the world “in the future, perhaps, if something happens.”

Nesmiyan on how miserable the BRICS in fact are. And the leaders of course pompoesly puff up their self importance. Kissinger once formulated it with words to the effect that one never looks to the global south for anything of importance.

Drowning men clinging to each other thrashing in the sea. Outlook?

—————————–

https://t.me/anatoly_nesmiyan/12322

In the new BRICS member Argentina , a wave of looting in the largest cities does not subside. The desperation of the people was caused by the ongoing economic crisis, which made even food unaffordable for many of them.

BRICS, generally speaking, is an association of countries in which dominating poverty is one of the main social features of each country. Including China, by the way.

India is a country where 75 percent of the population is poor. 300 million people do not have access to electricity, 100 million people do not have access to drinking water, 800 million people live in conditions that do not meet sanitary standards.

China in this respect is the most respectable BRICS country, in it “only” about 100 million people are among the poor, but this is a somewhat crafty figure, about the same as 12-14 percent of the Russian population, who are formally considered poor or low-income. In reality, the number of people in Russia who do not reach the level of the middle class in terms of their income is about 80 percent, which means that these are the poor or unsecured.

The new BRICS members have an even more egregious poverty situation. In Ethiopia, only officially below the poverty line (as sheer poverty is now called) lives 40 percent of the population. In Iran, like the flu, twice a year there are mass social unrest of people driven to despair by poverty. Absolute poverty (another term for poverty) in Iran is 20 percent of the population.

In Argentina, living below the poverty line (beggars) – about 30 percent of the total population. As the crisis escalated, their number increased to almost 40 per cent. No wonder desperate people are starting to demolish stores.

Simply put, BRICS is not just an association of poor, but desperately poor countries. And, in general, BRICS has a strategic task that can become an idea that unites countries – this is the fight against internal poverty.

But the leaders stubbornly consider and proclaim the tasks of competition with developed countries, counting various kinds of virtual indicators, according to which BRICS is already ahead of the G7. This means that the fight against poverty for the BRICS remains a purely side activity of this alliance. Which, in general, predetermines the futility of its existence.

——————————

6th day of rioting in Argentina – video

https://t.me/svezhesti/87025

✔️On the sixth day of mass looting in shops in Argentina, the police began to guard supermarkets and the largest stores with shopping centers

Marauders are most active today in Santa Fe and Rosario. The police use rubber bullets and actively arrest the looters. Many shops have been temporarily closed for fear of robberies since yesterday.

In terms of the de-dollarization of international trade, there is a recent history: the $US replaced Pound Stirling as the global reserve currency as a result of the Bretton Woods Conference.

Once the decision was made the change was rapid, and the Pound Stirling went from being As Sound As A Pound to being an also-run within a decade.

So I suspect the $US will lose its exorbitant privilege in a decade or so. Maybe a bit longer because the USA won’t go quietly into the night in the way that the British decided not to fight the inevitable.

The Wall Will Fall…No Rice..No Chicken…No Almonds..No Pork..No Eggs or Noodles in That Soup…Fortune Cookie for Fools..

What would the price of a barrel of oil be if we hadn’t attacked Iraq and Libya and sanctioned Venezuela, Iran and Russia. These are all top oil producers which have had their production curtailed except Iraq is now back.

Gordon Reed,

I’m not sure it would make much of a difference. OPEC had to recently cut back on production in order to maintain prices in spite of all the disruptions you mentioned. It all tends to blow a hole in the peak oil theory.

Sir what you say is absolutely true. However may be we should look at our own govt, did Pres Biden release oil from the strategic reserve to keep the oil prices down so he could sock it Putin? The Arabs as much as we would love to think as stupid are not stupid, they saw the handwriting on the wall and got the message. The only way to survive in such a predatory world was herd mentality and they got togetether in OPEC+ and cut the production so as to stabilize the oil price. Thanks

Muralidhar Rao,

Remember how oil prices spiked at the beginning of the Russian invasion and the ensuing sanctions? I think the release from the strategic oil reserve was in response to that spike. I think OPEC also cut way back during the Covid pandemic when economies collapsed left and right. Prices dropped to damned near zero at that time. Cutting back was the only prudent thing for OPEC to do. You’re right. They’re not stupid.

OK, a kind of serious response to expansion of BRICS membership. Of the 11 proposed nations only three have anything the rest of the world wants to buy; gas and oil. If the wokie environmentalists have their way hydro (and newcler ((remember George don’t you)) will replace fossil so fossil fuel countries may have a short “shelf life”? Eight are abjectly poor and 3 have very fragile civil governments. China/Russia and China/India have serious unresolved border disputes. Iran hates Arabs/Jews/Turks/Kurds and Americans and South Africa is but a coup away from chaos. On the other hand, if BRICS is further expanded to include Eritria, Somalia, Paraguay and Uruguay there’s no telling how much impact the Bloc could have on world trade. I’m taking a wait and see look on this one.

Billy Roche

I see we are back to Tom Lehrer again! Btw, China and Russia resolved all outstanding border disputes in 2004: https://en.wikipedia.org/wiki/China-Russia_border

BA; disputes may be resolved on paper and also may be unresolved. Nations have no permanent friends and often “temporary” ethics.

Barbara Ann –

Re China-Russian border disputes. They may have been resolved back then to Moscow’s satisfaction, but apparently Peking has some new ideas. China Standard Map Edition 2023 shows the entire Bolshoy Ussuriysky Island as Chinese instead of the half-and-half previously agreed on:

https://www.msn.com/en-us/news/world/where-is-bolshoy-ussuriysky-island-at-heart-of-russia-china-border-dispute/ar-AA1g36Il

There is also some gnashing of teeth in Delhi over that map showing “Arunachal Pradesh and the disputed Aksai Chin plateau as China’s territory”.

What will happen to BRICS if China keeps taking more bites of land from the other members?

leith

Good find. Those darn cartographers eh.

Btw, did you see Strelkov has launched a bid for the presidency of the RF. In his 6 point pitch he cites the following advantages over the current president:-

– The fact that he is more competent in military affairs

– The fact that, unlike the incumbent, he doesn’t put any faith in the Kremlin’s “trusted partners” in the West

– Similarly he is not “too kind” – a dig at Putin’s domestic ‘trusted partners’

– He has no billionaire friends to whom he owes favors (“I don’t have a single friend, even a millionaire”)

– He is not moral and can therefore break any promises that were made to the folk who brought VVP to power

– He is not athletic and therefore cannot be expected to bother “you, dear voters” by remaining in office for 20 years!

You’ve gotta love this guy and his sardonic wit – all from his jail cell. He reminds me of the best traditions of resistance under the Soviets – Brecht and so on. Well worth a translate and full read IMO.

#Girkin2024

https://t.me/s/strelkovii/6317

You’ve got to wonder how the beating and hospitalization of a Palestinian reporter in St Petersburg will influence backlash, if any, against BRICS in the Moslem world? She was working for Al Jazeera and was accosted and badly beaten by a Russian passerby because she was speaking in Arabic while on camera. She’s in the hospital with a concussion and severe bruising.

https://twitter.com/Tendar/status/1695407907985367440

Probably will not be shown in KSA and UAE as they have long banned Al Jazeera. And it is not clear to me whether Al Jazeera is broadcast or webcast in Farsi for Iranians? Plus the Russian Arabic ‘Rusiya Al-Yaum’ TV channel broadcasting in Arabic, a competitor to Al Jazeera, will undoubtedly say the video of her attack is phony agitprop by the is wiley anglo-saxons.

leith

The Gulf States have long since given up caring about Palestinians in Palestine. The fact that the KSA, UAE and their arch enemy Iran have all joined BRICS proves one thing; business trumps everything else. Also, there is a precedent for enemies joining international groupings simultaneously – India and Pakistan joined the SCO together in 2017. Very smart – much harder to get one to join if the other is already a member I guess.

Barbara Ann –

True. But she wasn’t attacked for being Palestinian – she was assaulted for speaking Arabic in Russia. I’ll give you 100-to-1 odds that the thug who battered and bruised her did not know whether she was Palestinian or Saudi, or Martian for that matter.

And it does not matter, Arabs in the Gulf States and Egypt and Iran will never hear about reporter Rania Dridi’s beating. Al Jazeera is banned in all those countries. Too bad about that, they sure heard about the Muslim bashings that happened in the USA after 9/11.

leith,

did she do any reporting from Yemen for the folks in the Moslem world to read about? Speaking of banned news, RT is banned in France, and shortly a lot of outlets will be banned in the EU unless they conform to the latest regulations. Ok, not ‘banned’, just forced to conform to government approved information reporting. We know how much – Russia collusion, 51 intel professionals, etc. – of that there was not too long ago.

https://www.cnn.com/2023/08/25/tech/eu-launches-big-tech-regulations/index.html

The South African Rand Slid 1 %…..On the Last Day of the BRICSA Aummit

on The Strength of the U.S.Dollar… ..

The Story ..About All This BRICSA Activity says there there is “NO Commonalities

Among The SIX Nations Invited (By CHINA?RUSSIA..?) To Join BRICSA..

REALLY…?? This is all Strategic…Planned Objective by China/Russia..Staging..

COMMON…ALL Have Seaports…Coastal Access…Locations…Military and

Economic Shipping..Precious Metals..Oil…Coal..Food…Strategic Placement..

The NEXT SIX…Certain Global CONTROL…666 BRICSA..+USAIEE+ ??

The Hungarian Broke the Bank..England Sank..And HE Sailed to America..

The STANK Game..”.. Anyone Still Home At ICC…or are ALL The Lights turned

OUT..?

On the de-dollarization front:

https://dailyhodl.com/2023/08/25/brics-member-india-ditches-us-dollar-purchases-1000000000-barrels-of-oil-with-rupees-for-first-time-ever-report/

Are U.S. mainstream media covering this much?

As opposed to the issues they prefer to push?

I don’t know.

Keith,

Fear not. The USN will still protect tanks carrying UAE oil to China.

What will UAE do with the rupees they receive from India whose value is constantly depreciating? And what percent of UAE oil sales does this represent?

blue peacock,

Another question is what will Russia do with the rupees India forced them to accept for their heavily discounted oil? India has little Russia needs to buy.

bp,

buy stock in Indian companies listed on the India stock market. Given enough rupees they can start gobbling up enough shares to begin telling the boards to do things the way they want, just like BlackRock does.

I think y’all want to try to if possible to wrap your heads around the assertions in this post of Anatoly Nesmiyan’s. It would appear digital money provides an obstacle to China’s ambitions of solving its debt and currency issues? I don’t know.

Sam Bankman-Fried’s thieving and dissimulating career (son of Stanford U Law professors, or was it Ethics?) sure doesn’t convince me otherwise. Pasted from machine translation.

Before reading his text in 1, read this * which he links to:

*Underground cryptocurrency businessmen are being caught in China. They are rented out by research companies that report data to the relevant authorities. The police take away access to wallets and servers, the crypt is exchanged for yuan. Businessmen go to jail for fraud and money laundering. Part of the money obtained becomes the legal income of the police, and the companies that hand over the criminals receive a reward. Headhunting. @BlackAudit

———————————————

1- Anatoly Nesmiyan:

In general, an understandable story . China has not yet announced the transition to the digital yuan, although its readiness for this is simply orders of magnitude higher than in any other country. The social rating system has already been built, it has not just been implemented, but has become stable, which means that the basic task of introducing a digital currency as an instrument of economic control over the population has already been solved, since many other types of control have been introduced, act and accepted at the mental level.

However, digital currency, due to its nature, is absolutely not able to “get along” with any other types of money. Control or should be total, or it is not. Cash and cryptocurrency do not fit into the history of control, and trying to create control over them is a waste of resources, and with a very dubious result.

By the way, this is why cash circulation is practically prohibited in Australia – the niche for cash payments today is extremely compressed, banks stop working with cash, and the population is almost accustomed to the fact that cash is something very shameful. The West is also going in this direction, but Australia is just a reserve of digital normality here.

China is also moving in this direction, but it is cryptocurrency that poses the main threat to digital money, including in terms of the threat of capital withdrawal. For the Chinese financial authorities, the problem of capital flight is a threat of the highest order. It is the only reason why China cannot introduce the convertibility of the yuan, since all scenarios and models in which the yuan becomes convertible show that the first reaction will be a literally massive flight of capital from the country. After some time (here lies the main discrepancy between the models – in the definition of this time period) the situation will stabilize, and under certain conditions, capital will begin to return. But the problem is that the Chinese economy in almost every one of these models does not survive the shock at the moment of flight.

Therefore, the convertible yuan for China is a closed topic. Although he could rid China of all its current problems and even help it restart the economy in a completely new development model. But the risk of failure at the transition stage is too high.

The poet has to go a long way. And even very long. Through a digital concentration camp, through a social loan, through a digital yuan – and the inevitable in this case, the fiercest fight against cryptocurrencies.

CNN offers what seems a balanced perspective here:

https://www.cnn.com/2023/08/28/china/china-brics-expansion-victory-intl-hnk/index.html

BRICS expansion is a big win for China.

But can it really work as a counterweight to the West?

Analysis by Nectar Gan, CNN

Published 11:34 PM EDT, Mon August 28, 2023