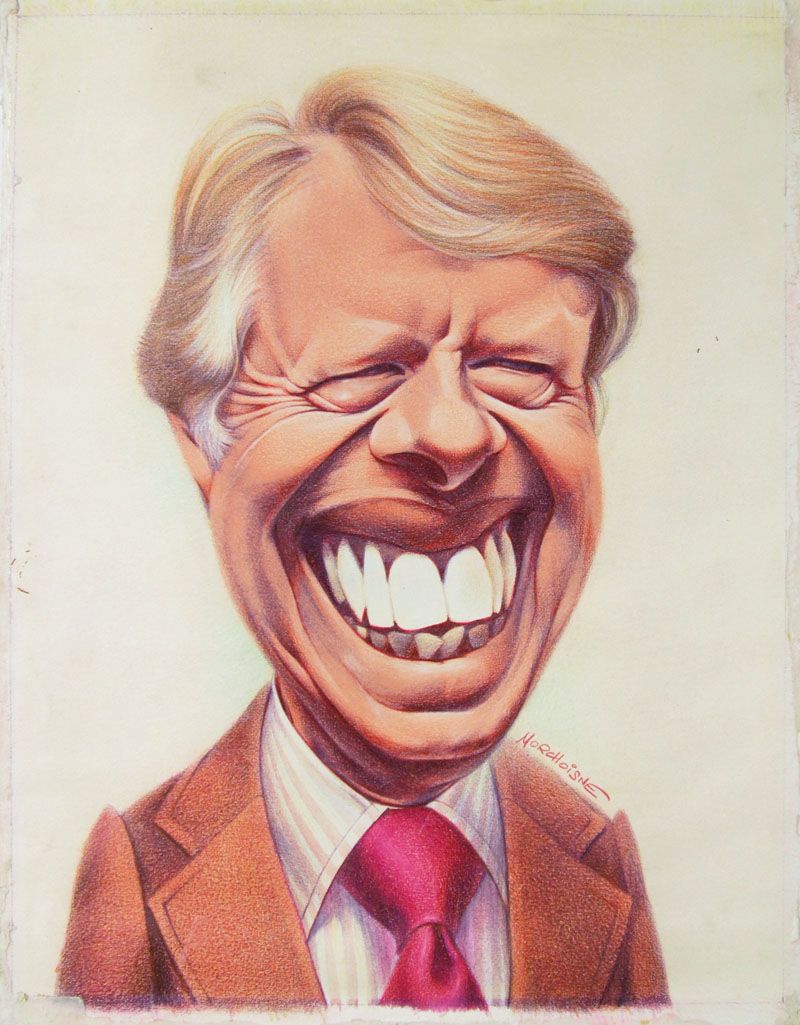

“Gas prices are surging across the nation with California recently setting new records of consecutive days at nearly $4.70 per gallon. Unfortunately, Americans hoping for some relief at the pump will have to wait a little longer as analysts are predicting the high oil and gas prices will remain for the foreseeable future. Natural gas prices are also expected to remain high, with the U.S. Energy Information Administration (EIA) forecasting a 30 percent increase in home heating bills this year. The Biden administration is scrambling for solutions, but its Carter-esque approach will only take us backward.” RCE

Comment: A good fellah really and a hell of a survivor but he, like Joe Joe, was always a bit out of his depth. pl

Inflation seems to be a worldwide problem. Russia’s annual rate is well above 8% for 2021 with food above 10% and accelerating rapidly. The Russian central bank is going to increase borrowing rates in an attempt to tame inflation… just like our central bank. Is Putin also out of his depth? Maybe it’s the whole world economic system that’s seriously out of whack.

TTG,

https://twitter.com/dkstadium/status/1471822531615150088?s=21

It appears a big contributory factor has been the lockdowns. The constant and arbitrary start-stop of economic activity based on the quack The Science and monomaniacal focus on a singular vector.

There have also been some own goals which have developed over years. One example being Merkel shutting down German nuclear power production. And now even more dependent on Putin’s natural gas.

https://twitter.com/disclosetv/status/1470371516319768579?s=21

It’s like California shutting down Diablo Canyon and then having Public Safety Power Shutoffs as the grid becomes unstable which forces folks to power their essentials with diesel generators. Yeah, but Gavin has all the “green” rhetoric.

In any case the US bond market believes that inflation is “transitory”.

https://twitter.com/dylangrice/status/1471858199087263751?s=21

If it isn’t as Dylan Grice notes. It will be an epic shit show since all the highly leveraged derivative trading and DCF models is keyed off this bet.

As I have noted many times here, the Fed is trapped. They haven’t raised rates yet and they can’t raise it too far. Remember we’re still at ZERO. The equity market will take it on the chin and the real owners as Carlin noted years ago will scream bloody murder and the Fed will be back, pedal to the metal on the printing press. The real place to watch is the bond market as they’re pricing in a recession. If inflation goes runaway then hallelujah!

Sam

“The real place to watch is the bond market as they’re pricing in a recession. If inflation goes runaway then hallelujah!”

Yes.

We have to start with the Fed’s inflation indicator which is the PCE deflator. This has been suppressed to justify the Fed’s balance sheet growth. If one were to look at the CPI, for example, based on how it was calculated in the early 80s it would be substantially higher today rising at double digit rates.

The bond market is saying right now that inflation is transitory. So is the Eurodollar curve which the Fed doesn’t control. Powell and crew are on their knees praying that this is true.

Another factor to consider is USD strength even in the face of rising rate differentials. If the Fed goes on a rate increase campaign it will only add to USD strength which would crush emerging markets with large USD debt.

As you correctly point out the Fed is trapped. Rising rates shrinks multiples which pressures the stock market and we’ve seen how the Fed reacts if there’s a nasty selloff. Additionally, it increases the federal government’s interest payments on its growing debt now approaching $30 trillion.

If inflation is persistent on the other hand and keeps rising the bond market could runaway. This would be as Dylan Grice says a “shit show”. The systemic leverage would have to be reduced and we’ll see panic among all the highly leveraged traders and those with massive debt on their balance sheet who would have to unwind. The 40 year speculative party on lower & lower rates would go on reverse. The scale of default will make 2008 look like a picnic.

Persistent inflation is enemy #1 for a highly leveraged global financial system that is already underwater and needs rising credit growth to keep the system afloat. Yes, indeed watch the bond market!

The US is under sanctions like Russia? I hadn’t heard that.

“Maybe it’s the whole world economic system that’s seriously out of whack.”

Multiple governments interfering in the markets in the #1 cause. Or did you not hear about covid as an excuse to lockdown, failure to vaccinate an excuse to fire employees, and regulatory action in closing pipelines, banning fossil fuel vehicle sales, and envirnomental regualtions to eliminate multiple ocean freighters from service?

Fred,

So now it’s our meager sanctions that are causing such turmoil in the Russian economy? They mostly target oligarchs and politicians rather than large sectors of the economy. I thought all you admirers of Russia and Putin were sure Russia was impervious to such sanctions. As far as covid affecting economies goes, including Russia and the US, I’ll buy that. But how has any of those calamities you enumerated affected the Russian economy? They haven’t done any of those things.

I have a lot respect for Jimmy as a human being. He never cashed out on his office unlike Slick Willie and Obama. He didn’t join the celebrity circuit nor did he poke his nose in domestic politics. He stuck with Rosalyn and wasn’t on Epstein’s Lolita Express or Branson’s Nekkar island. He is a humble man and his Creator will treat him well.

Then you have our nation’s premier law enforcement agency:

https://www.buzzfeednews.com/article/kenbensinger/fbi-michigan-kidnap-whitmer

Please read this to get an idea of the descent.

First, Carter could relax when Obama took his place as the worst POTUS in history.

Now, Obama can relax; his crown has been passed.

Not a bucket if warm spit worth of difference between them, GW and Trump they just seem to get progressively worse.

Obama is still in charge through his proxy Susan Rice, so he’s still the worst, but there’s a lot of competition stretching back generations. Wilson, FDR, LBJ., the list goes on.