“The US is on the cusp of a pronounced boom, having recovered in the first three months of this year as businesses reopened. The world’s biggest economy grew at an annualised 6.4pc during the first quarter, rebounding much faster than expected after last year’s sharp fall.

This growth is built in part on the US vaccine programme. Around 143m Americans – 43pc of the population – have had at least one jab, with 10m doses administered over the last week alone. This has lifted confidence, helping consumer spending in April hit a 14-month high.

We’ve also already had a $1.9 trillion (£1.4 trillion) Covid recovery stimulus – much of it spent on cheques sent directly to individuals (the latest, in March, for $1,400) and lavish aid to state and local governments.

Yet, on top of that, Biden has just unveiled another $4 trillion of stimulus, split between social safety net spending and investment in infrastructure and green jobs. Such spending is astounding and, with the economy accelerating fast, could also be seen as reckless.“

Comment: I was among the many who did not watch the Oscar nonsense so I know nothing of “Nomadland.” SWMBO was unhappy that the program did not show clips from the nominated flics so I was allowed to ignore the whole thing.

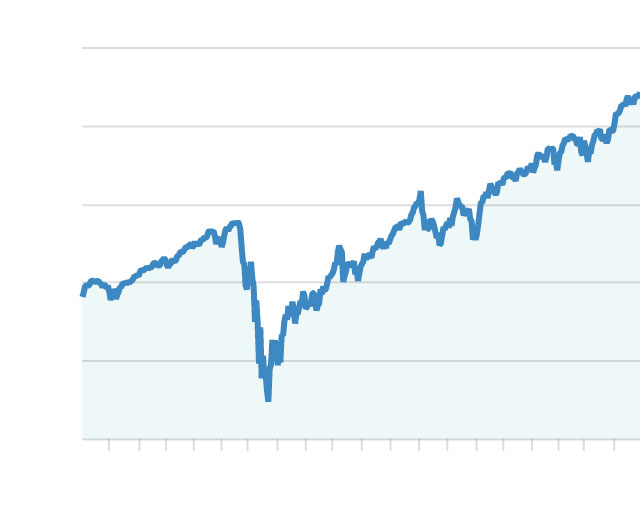

I think that my bank’s trust department is correct in advising me that “what goes up must come down.” The Bidenistas are intent on pumping funny money into an economy already expanding at a rapid rate. IMO there will be a continuing “sugar high” from all that money. This will go on for some unforecastable period of time and then there will be a failure of confidence among investors in both the economy and the markets. This will result in a serious fall in values.

I have been reducing our exposure in the equities markets for some time and will continue to do that. pl

https://www.telegraph.co.uk/business/2021/05/02/bidens-bazooka-could-scupper-us/

Wow: you are braver than I….I never got back into the market after being trounced in 2000 and 2008.

I still keep some silver about should there be a big problem.

I wish I could wrap my head around the bits and pieces concerning economical context data as to post-9/11-events …

Trounced in 2000? You invested into the larger Dot-com-bubble at the time? Betting on the wrong horse?

unrelated: Forget, can anyone tell me when TTG’s-one-month-temporal-ban ends? Although, I am not quite sure if I would return, if I were him, I surely hope he will.

leander

He is not banned.

LeaNder, As Colonel Lang said, I am not banned. I never was banned. I just lost my guest authorship privileges for a spell. Those were restored a couple of weeks ago. I haven’t authored or commented since then because I was occupied on other matters. Most importantly, my 91 year old father died about that time. We all knew it was coming, but he went out with style. He was teaching his hospice caregiver how to garden just days before he went. He survived two wives, cancer and a massive heart attack among other things. He kicked death in the nut sack so many times that I’m sure the grim reaper approached him with great fear and trepidation. We plan on gathering later in the summer to spread his ashes in his favorite fishing spot.

TTG,

May your father’s soul rest in peace.

Degringolade

Yes. I probably am. Ah, you are the clown who despises Old Army quarters and posts.

Features continue to be confused with bugs.

Which means the ‘torpedoes’ are quite deliberately and well aimed.

The public sector and Democratic allies, unions, State Governments are being paid off whilst at the same time the private sector economy is being damaged and undermined hopefully fatally. The torpedoes may be considered commerce raiding, as are taxes and regulations etc etc. The Dems are the U-Boats and the non-public economy the merchant marine.

Punish your enemies while rewarding your friends.

This notion of the common good and the plaintive wailing of ‘why are they doing this?” will die very hard, now won’t it?

Recycling tax dollars or simply printing more money does not create new wealth; just more future Democrat victories.

Which repeats the same folly until Margaret Thatcher appears yet again on the horizon and OPM has dried up.

Grow quinoa in your back yard or in pots on the balcony.

Some weeks ago, JP Morgan was estimating and advancing the “pandemic” will end by April this year….

What this big bankers would know that we do not?

https://twitter.com/smolny7/status/1387350532008853504

Wondering whether this of the mRNA vaccines will become another scam like that of “Tamiflu” where Donald Rumsfeld had shares….

If that ends to be so, and billions of dollars and euros end lost and missused hijackimg them from more necessary accute needs, i hope all the heads involved roll, both at the US and the EU….

As banks in the EU are largely benefitting from the artificially proloongation of this “pandemic” by sending to unemployment and early retirement hundreds of thousands of people, while at the same time saving hundreds oft housands in taxes, I very doubt we will see a soon end of this in the EU, since they have achieving more than what they achieved in the 2008 crisis without any complaint and movement from the population…

Last time, now a decade ago, the rythm they repeat crisis in an undending way, the streets were occupied in several countries of the EU by a huge crowds refusing to leave to home unless justice was done, there were born the “Indignados” movement in Greece, and 15-M Movement in Spain which then gave birth to new parties of the so called “Euroleft”, which leaves some people in the real classical left to think that these leaders, who organized the dismantling of dissent in the streets to canalize it towards the party system, were really controled oposition, since they are today in power and do not say a word about the assault of people´s freedoms and sovereignty the in fact mandatory vaccines, lockdowns and curfews constitute…

Related to this, Warning for sailors…( ie. investors…)

There is talk that some airliners and hotels are already irganizing alternative flights and stays for unvaccinated people, as some entrepeneurs have tested there is really a market out there they are not willing to lose in the “recovery”period.

All this people, hard to peel, are willing to remain another year, or whatever is necessary, without travelling or going to any leisure public activity, and thus without spending in travles, vactions and cultural activities they previousl ywere doing several times a year unless they are alloowed to decide over their person in such a fishy issue like experimental medical products…

I for one as soon as I am calling to a hotel this year and it happens they ask me for any “vaccination passport” will be hanging up the phone and dialing another number…

I think a new market could be growing from this, and instead of having to co with the usual varied holydays groups, a more likeminded groups of tourists will be done, facilitating thus way meeting and even marrying, with which sharing political ideas which could lead to more effective action and continuing populating Earth will be easier than before for wide disgust of eugenicists like Gates, Soros and the trnasgender gay troop in the Big Tech mafia .

On the other hand, a break down of society into two tiers will be favored, and intolerance to other ideas will grow, paving the way for future civil wars or desintegrating of nations into little tiny pieces, probably another goal the elites impossing this are looking for…

Tamiflu was a media ginned up scam – lurid stories of dead children and a “shortage” of flu vaccines. I remember it well and reacted with deep cynicism since the duplicitous players were well known for other fake drug scams for the worried well.

Create the fear, provide the drug and then concoct “shortages’ to drive up demand – and full court media coverage.

I do believe Pfizer picked up the same company that ran the Tamiflu scam, once “science” proved the heinous nature of their prior drug marketing schemes. But it has been a while and I need to check my facts.

Col. Lang,

Biden piling on federal government debt is not new. Each president is more profligate than their predecessor. Trump grew debt by over a trillion dollars during each year of his presidency. Obama doubled the debt during his term. George Bush doubled it in his term. The Republican “god” Ronnie Reagan tripled the debt during his term. Spending by the government for decades has rocketed. The question that needs to be asked is what can we show for all this spending ? We’ve added $20 trillion to the national debt between 2000 and 2020. Do we have spanking new infrastructure or just the same dilapidated roads, grid, rail? We spend a boat load on the military what can we show for it in terms of combat effectiveness and operational readiness? The next question naturally should be cui bono?

Productivity hasn’t grown nor has real household income. Inflation in housing, medical and health care, education and food has been real for the average American for years. While they’ve been falling behind in terms of standard of living the Ph.Ds at the Fed claim there’s no inflation and they need to spark more of it.

In this environment where market power has been increasingly concentrated for over 50 years and government interventions and edicts on behalf of the oligarchy has also grown consistently for over 50 years, who should be held accountable? It’s not just Biden and the Democrats but also every Republican.

Debt has grown not only on government balance sheets but also on the balance sheet of corporate America. Most of it to buyback stock and other financial engineering not for capital investments or increasing productivity of their businesses. The real economy continues to be hollowed out and this increasing leverage is going towards financial speculation. Why not, when both Republicans and Democrats are firmly behind privatization of speculative profits and socialization of losses on financial speculation. Archegos Capital blew up recently. Prime brokers had provided it over $100 billion in leverage. Their speculation in “stonks” caused crazy volatility. Yet where’s the SEC? Where’s the FTC on unprecedented market concentration? They’ve been taken over by the oligarchs in the revolving door. The kleptocracy is running wild but the majority of Americans in the bottom 80% are too busy shouting epithets at each other.

There are some strange happenings in the bowels of the financial markets. Lumber, ag commodities, metals, semiconductors, housing markets are all rising in price. Some substantially. Homes being snapped up at prices much higher than the listing price in multiple all cash offers. Lumber to build a deck skyrocketing from under a $1,000 to now nearly $4,000 in just the past 12 months. Yet the gargantuan T-Bill auctions to fund this growing debt yielding zero.

In the open thread I suggested a book “When Money Dies” which chronicles well the social descent during Weimar Germany as the devaluation of the reichsmark accelerated. A sentence in the book that has remained with me:

“As the old virtues of thrift, honesty, and hard work lost their appeal, everybody was out to get rich quickly, especially as speculation in currency or shares could palpably yield far greater rewards than labour.”

While history doesn’t necessarily repeat and it is unlikely we’ll see the exact replay of Weimar, there’s clearly a similarity. That’s the transition from thrift, hard work and honest, transparent economic values to financial speculation and consolidation of market power with growing government interventions on behalf of the oligarchy all propagandized with sophistry that defies age old common sense. This transition is 50+ years in the making. This is not just Biden but all his predecessors too going as far back as Richard Nixon.

The Phds at the Fed don’t get COLA, if they don’t drive up inflation.

There’s no COLA. The CPI and the PCE which the Fed says they focus on understate inflation experienced by Joe6Pack. Anyone that has to pay health care premiums knows what real inflation is but that never shows up in the metrics used for COLA. Same with housing costs and the cost of education.

What the Fed wants is inflation in financial assets to benefit the revolving door of Bernanke, Yellen, Geithner and Powell. These guys come from and return back to Wall St. How much has Blackrock, PIMCO & Citadel paid these guys over the years?

https://abi-org-corp.s3.amazonaws.com/articles/images/CPIChart2018.png

The Obama-Harris people believe it was their stimulus that caused the economic boom in the Trump interregnum, falsely, hence they are going big and going early. Truth is it was the shale oil boom, a private sector development in spite of the Obama people, that kept the US economy going under Obama. I suspect they are as delusional on the state of the US economy, debt and the US Dollar as they are most other things. In USD gold has completed a perfect multi year cup and handle pattern, bad things have to continue to happen to drive it to the $3000 level, and so they will.

Supply and demand, what are they? Federal regulations, say what?

Environmental regulations impacting economies? See Canada, which is about to get shafted worse than the oil shale industry was by Biden:

“Looming showdown as Michigan governor orders Line 5 pipeline to Ontario shut down”

https://nationalpost.com/news/canada/looming-showdown-as-michigan-governor-orders-line-5-pipeline-to-ontario-shut-down

Any thoughts on Bitcoin and other

Cryptos regarding fiat currency inflation?

A promissory hedge or another Ponzi?

According to Daniel Estulin, who at this point in time looks more like The Oracle at Matrix, another Ponzi….

The only promisory hedge which remains are physical metals, silver and gold, of course not at hand of common population whom will lost everything of the few they have saved.

Of course, not escapatory if they decide one day to requisition metals also..unless you have it all in Switzerland….in a vault…

Remember what happened to the national Venezuelan gold deposited in the Bank of England…

The concept as I understand it crypto is

The digital equivalent of a prescious asset

Aka gold etc. Bitcoin is mined through an

Algorithm puzzle solving process put into

A block chain (bank) to the access of buyers

And sellers. So say the prophets of the

Concept.

What’s not to like

Bernie!

It’s easy to confuse a booming economy with inflation. In my little SW Florida town it seems to be booming. Home prices in my neighborhood have gone up 14% since the start of the year and are expected to go up another 4% by end of year. I don’t see that as inflation or a booming economy, we’re just getting hundreds of people moving here from northern lockdown states daily, except for the people still wearing masks, it’s very very normal here now and has been for months. We’ve also had a lot of snow-birds finally decide to call Florida home and are selling their properties up north. The numbers of people with cash and no need for a mortgage are astounding.

Restaurant owners are only seeing a 10-15% decline so far as “season” winds down. It used to be about 30% decline at this point. May 31st is when we’ll see which restaurants aren’t going to make it and will close. Restaurant workers are in control now and are demanding and getting more pay, dishwashers are now starting at $15 per hour and the shortage of workers is getting so bad that restaurants are adjusting hours open downward as they have not enough workers. A good waitress here can make $300 a day in tips. One owner told me his top waitress is making $600 a day (of course she puts in 11 hours a day and works 7 days a week)!

This all sounds like a booming economy but my guess is that it’s inflation instead. Therefore, I see stocks and real estate will continue to go up. Where else can you put your money? I believe we’ll see better off Asians, Europeans, South Americans, Middle Easterners putting there money here, who else is open for business but us?

Bit of a myth stocks and property do well in high inflation, initially they do but then they stagnate as interest rates start to rise, even if rates remain negative in real terms, and company profits get eaten up by cost increases in raw commodities. Only commodities and precious metals do well in high inflation.

Quick calculation: $600 x 365 = $219,000. Almost as much as a starting government employee in California, and a lot more work.

Admire her hustle, hope she blames Biden when they take half of it all because she is now “rich”.

Fla real estate going nuts. I now get 2-3 robo calls a day wanting to buy our little 2 br home in west Pasco County.

Now went through this some in the run up to 2007 bubble. Zestimate ran up to $100k then in the bust down to $20. But today it’s saying $133k. (Of course, compared to living in Hawaii, Fla is pocket change .)

On corporate stocks, been hearing the “end is near” since the mid-90s from Elliot wave types. Rode out 2000 and 2007 and now 2020 with no damage. Didn’t try to time things.

Not sure how I would move into metals even if I wanted to. How many Eagles do I want to keep track of (and my state collects 4.5% on the sale)? Or pay someone to hold metal for me? Or do you mean play around with GLD (suspect that’s not what was meant).

I guess we will find out if MMT is really a thing or just BS.

I can not advice you with respect buying metals, as I have not researched in deep the issue since I have not enough money to lose…

I have followed analyst Daniel Estulin from some time now and so far he has been right in advancing most of the events we are witnessing/suffering right now, thus, IMO a very well informed person. You may agree with him in some of what he says, in much, or in few..whatever, but he has proved himself right all the time .

At one moment in time, when he was advising people already months ago to buy gold and silver, he stated he has a trusted source in Switzerland from whom he uses to buy gold, serious people who send your investment with required certificate.

He is offering private advisory through email or video conference for people interested…for profit, of course…

Estulin is suggesting buying gold and silver coins if you can only do a little investment.

Not jewelery, as you will lose always some part in case you would need to monetice it after hurricane passes…

The point is not losing your life earnings/savings as paper money lose purchaising value, which all paper money are doing one way of the other at this point…. and escalating…

Homes in our complex topped at $480,000 in the 2008 “boom.” A realtor friend who lives in the complex just sold two houses this week, cash, without even listing them. One went for $775,000 the other for $790,000. And the financial bozos say there is no inflation. (Both houses were built in 1973.)

https://twitter.com/markallanbovair/status/1389207017911373824?s=21

I dont see a problem.

Salaries up good for everybody.

Gas prices up result of supply and demand.

Gas is a commodity. Nobody was buying gas after covid outbreak.

Homes up 12 percent same scenario.

Covid stimulus good.

We needed some trickle up since Reagan